FEB establishes the “Audit Information” Section

The Financial Examination Bureau (FEB) has established the "Audit Information" Section on its website. The purpose of this section is to enhance communications and exchanges of views between the FEB and internal audit departments in financial institutions, as well as to provide more convenient access to understand financial auditing.

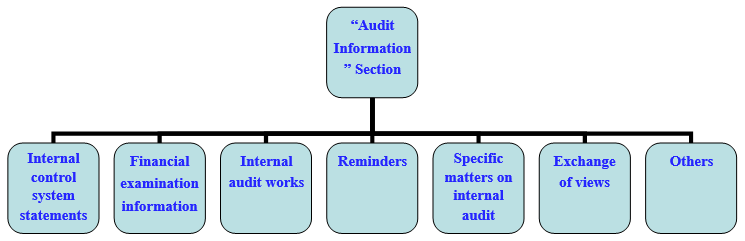

A. The framework of “Audit Information” section

B. This section focuses on the following three functions:

a.Information transparency: It discloses financial institutions’ implementation of internal control and conveys important information of financial examinations.

i.“Internal control system statements”: This part provides supervisory requirements on internal control system statements for financial industries, e.g., financial holding companies, etc. It also discloses the declarants and primary contents of annual internal control system statements issued by financial institutions.

ii.“Financial examination information”:

1. This part provides links to financial examination information, e.g., annual financial examination focuses, examination manuals, examination checklists, primary examination findings, etc.

2. It also provides matters which financial institutions need to coordinate with examiners during full-scope examinations.

b.Supervisory concerns on internal audit: It provides supervisory requirements on internal audit, the key deficiencies uncovered in financial examinations, important supervisory requirements with the expiration dates within 2 months, and review results of implementation of specific matters conducted by financial institutions.

i.“Internal audit works”:

1. This part provides applicable regulations of internal control and internal audit, and standards for professional practice. It also provides the function to search regulations of internal audit.

2. It also summarizes the primary examination findings on internal audit works, and Q&A, for industry professionals’ reference.

3. In order to provide the flexibility in executing internal auditing for domestic banks with off-site monitoring and other supporting mechanisms, the adoption of risk-based audit approach is encouraged.

ii.“Reminders”: This part provides links to important supervisory requirements with the expiration dates within 2 months to remind internal audit departments in financial institutions of processing those requirements.

iii.“Specific matters on internal audit”: This part discloses the review results on specific matters, at which the Financial Supervisory Commission (FSC) requires internal audit departments in financial institutions to conduct the review, submitted by institutions.

c.Two-way communications: The section discloses the meetings or seminars held by the FEB, and sets up the interactive communication channel which seeks comments from the public.

“Exchange of views”:

1. This part discloses the meetings or seminars held by the FEB.

2. It provides links to opinions and responses to FEB’s questionnaires conducted by its civil service ethics office.

3. It has established the interactive communication channel between internal auditors and FEB.

※ More details in the “Audit Information” section on the FEB’s Chinese website.